In the realm of business technology, NetSuite ERP stands out as a leading tool, pivotal for driving efficiency and growth. This comprehensive guide delves into the financial aspects of NetSuite ERP, exploring both its cost and the Return on Investment (ROI) it offers. Understanding these elements is crucial for businesses in the Philippines looking to leverage this powerful solution effectively.

Understanding NetSuite ERP

NetSuite ERP is a cloud-based, integrated business management software that offers a suite of tools to manage key business processes in a single system. Its functionalities extend from enterprise resource planning (ERP) and financial management to CRM and e-commerce.

The key benefits of NetSuite ERP include access to real-time data, a customisable dashboard, and the ability to streamline business operations, thereby enhancing efficiency and decision-making.

Initial Costs of NetSuite ERP Implementation

Implementing NetSuite ERP involves various initial costs. These include:

- Hardware and Software Requirements: While NetSuite is cloud-based, ensuring compatible hardware and stable internet connectivity is vital in the Philippines.

- Consultation Fees: Engaging with NetSuite consultants for expert advice and optimal setup.

- Setup and Configuration: This encompasses the initial costs of setting up the system and tailoring it to the specific needs of the business.

Recurring Expenses Post-Implementation

After the initial setup, there are ongoing expenses to consider:

- Licensing Fees: Regular costs for using the NetSuite software.

- Maintenance and Upgrades: Ensuring the system remains up-to-date and functional.

- Support Costs: Ongoing support for troubleshooting and assistance.

Customisation and Integration Costs

Customising NetSuite ERP to suit specific business needs and integrating it with other systems is often necessary but incurs additional costs. This might include developing custom modules or integrating third-party applications.

Potential Transition Costs

Transitioning to NetSuite ERP can bring potential costs, such as:

- Operational Disruptions: Temporary disruptions to business processes during the transition period.

- Learning Curve: Costs associated with the time it takes for employees to become proficient with the new system.

Why do some ERP implementations fail? Some ERP implementations fail due to inadequate planning, lack of clear objectives, insufficient training, or resistance to change. Other reasons include poor data quality, unrealistic expectations, and choosing an ERP system that doesn’t align well with the business’s specific needs. Recognising these potential pitfalls is crucial for the successful implementation and long-term utilisation of NetSuite ERP.

Looking to secure a successful ERP implementation? Partner with Jcurve Solutions for expert guidance and a streamlined process. Reach out to us today and take the first step towards a fail-proof ERP journey with NetSuite.

Training and Employee Onboarding

Effective utilisation of NetSuite ERP requires comprehensive training and onboarding. This involves creating training materials, conducting onboarding sessions, and ensuring ongoing training is available to keep staff updated on new features and best practices.

How to handle conflict and resistance during ERP rollout? Conflicts and resistance are common during an ERP rollout. To manage these challenges, engage employees early in the process, communicate the benefits and changes transparently, and provide adequate training. Address concerns promptly, involve key stakeholders in decision-making, and ensure top management support to facilitate a smooth transition to NetSuite ERP.

Total Cost of Ownership (TCO)

The Total Cost of Ownership for NetSuite ERP extends beyond the immediate expenses. It includes:

- Direct Costs: Such as licensing fees, maintenance, and support.

- Indirect Costs: These might include the time spent by internal staff on ERP-related tasks.

- Future Costs: Anticipated expenses for upgrades or additional customisations.

- Opportunity Costs: The costs related to potential alternatives and the benefits they might offer.

Understanding TCO is essential for businesses in the Philippines to make informed decisions about their investment in NetSuite ERP.

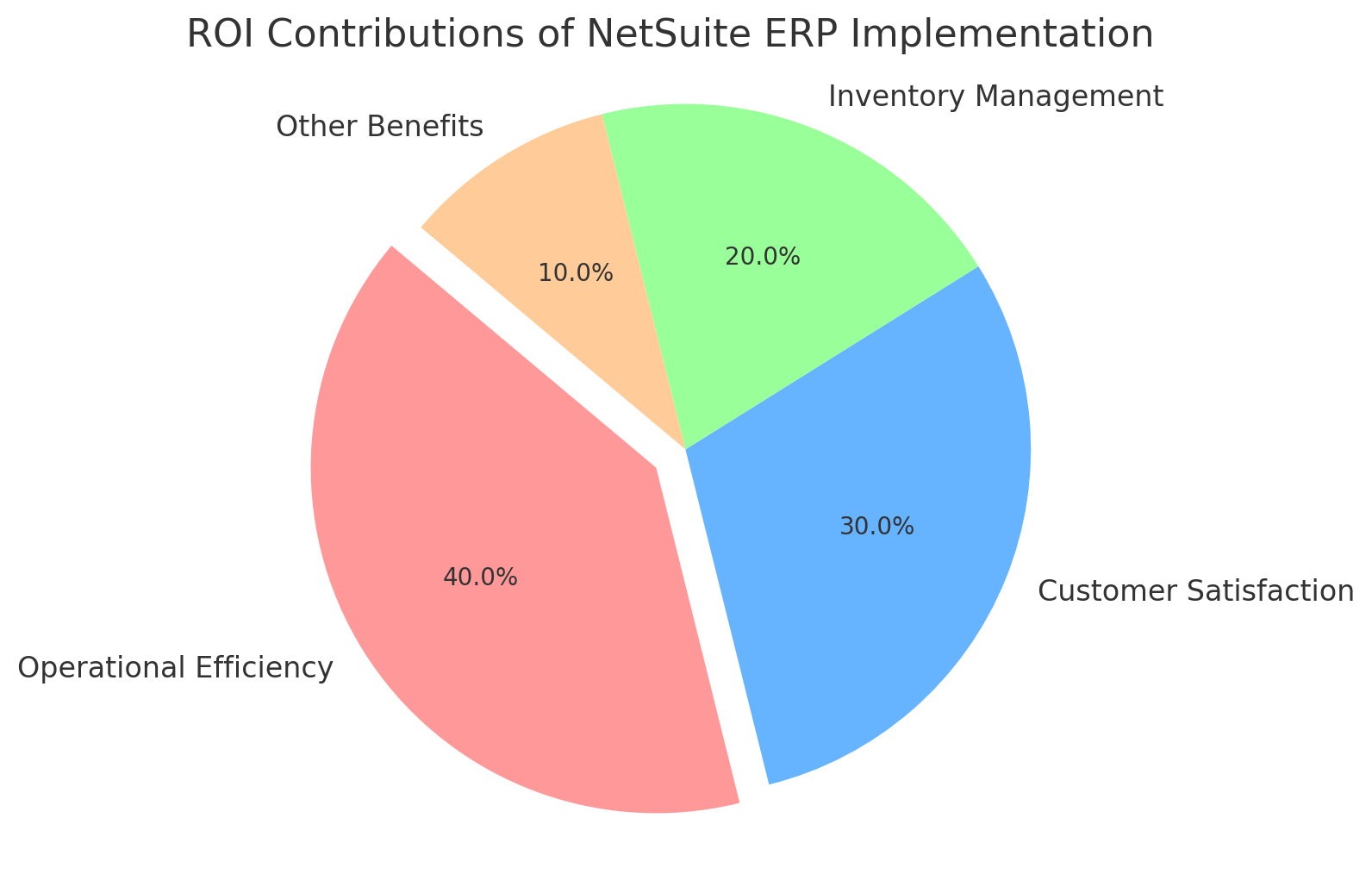

Assessing ROI of NetSuite ERP

The ROI from implementing NetSuite ERP can be substantial. Key areas of return include:

Inventory Management Improvements: Better inventory tracking can reduce costs and prevent stock shortages or overages.

Operational Efficiency: Streamlining processes leads to time and cost savings.

Enhanced Customer Experience: Improved service can lead to increased sales and customer loyalty.

Assessing these factors helps businesses understand the value NetSuite ERP brings beyond its initial cost.

For more insights on enhancing ROI, explore these 7 strategies to see ROI from your ERP implementation sooner. These tips can help you optimise your NetSuite ERP investment and achieve financial benefits more rapidly.

How do you determine the ROI of an ERP implementation? To accurately assess the ROI of a NetSuite ERP implementation, consider both quantitative and qualitative benefits. Quantitatively, measure improvements in operational efficiency, cost savings, and revenue growth.

Qualitatively, evaluate enhancements in customer satisfaction, employee morale, and decision-making processes. Establish clear metrics before implementation and regularly monitor them to gauge the ERP’s impact on business performance.

To delve deeper into the financial benefits and uncover the hidden ROI secrets of investing in NetSuite ERP, explore our detailed guide: Unveiling the ROI Secrets of Investing in NetSuite ERP. This resource provides a comprehensive look at how NetSuite can transform your business financially, with real-world examples and expert insights.

Break-even Analysis and Cost Savings

Determining when the benefits of NetSuite ERP outweigh the costs is crucial. This break-even analysis helps businesses identify:

- Time to Break-even: The period after which the ERP system starts delivering more value than its cost.

- Areas of Cost Savings: Identifying which processes NetSuite ERP makes more efficient, leading to cost reductions.

Additionally, understanding how to expedite ROI is crucial. Discover how with these 6 strategic steps to gain ROI from ERP implementation faster, enhancing the value of your NetSuite ERP sooner.

Working with NetSuite Consultants

Engaging with NetSuite consultants can offer significant value, such as:

- Expert Advice: Consultants bring expertise that can streamline the implementation process and minimise costs.

- Cost Reduction: Leveraging their knowledge to avoid common pitfalls and unnecessary expenses.

- Engagement Tips: How to work effectively with consultants for the best outcomes.

If you’re considering implementing NetSuite ERP or looking to optimise your current setup, Jcurve Solutions is here to help. Our team of expert NetSuite consultants is dedicated to ensuring your ERP implementation is a success, offering tailored advice and solutions to meet your unique business needs.

Conclusion

The financial brilliance of implementing NetSuite ERP lies in its ability to transform business operations, leading to significant cost savings and enhanced efficiency. While the initial investment and ongoing expenses are considerable, the long-term ROI and operational improvements make it a strategic choice for businesses in the Philippines seeking growth and efficiency.